-

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

The Forex Legacy

1 × $6.00

The Forex Legacy

1 × $6.00 -

×

Ultimate Gann Trading

1 × $15.00

Ultimate Gann Trading

1 × $15.00 -

×

The FOREX Blueprint with The Swag Academy

1 × $5.00

The FOREX Blueprint with The Swag Academy

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Intermediate Guide To How Simpler Options Uses ThinkorSwim with Henry Gambell

1 × $15.00

Intermediate Guide To How Simpler Options Uses ThinkorSwim with Henry Gambell

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Email Academy

1 × $31.00

The Email Academy

1 × $31.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Ultimate Guide To Swing Trading ETF's

1 × $23.00

Ultimate Guide To Swing Trading ETF's

1 × $23.00 -

×

The Forex Equinox

1 × $54.00

The Forex Equinox

1 × $54.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00

Advanced Guide to How SimplerOptions Uses ThinkorSwim (274 Minutes) with Henry Gambell

1 × $15.00 -

×

ADVANCED Swing Trading Strategy - Forex Trading Stock Trading

1 × $15.00

ADVANCED Swing Trading Strategy - Forex Trading Stock Trading

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

NQ Full Order Flow Course with Scott Pulcini Trader

1 × $8.00

NQ Full Order Flow Course with Scott Pulcini Trader

1 × $8.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Ultimate Professional Trader Plus CD Library

1 × $31.00

The Ultimate Professional Trader Plus CD Library

1 × $31.00 -

×

The Forex Trading Coach Course

1 × $6.00

The Forex Trading Coach Course

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

The Foreign Exchange Landscape - InvestopediaPro with Mikesh Shah

1 × $6.00

The Foreign Exchange Landscape - InvestopediaPro with Mikesh Shah

1 × $6.00 -

×

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00 -

×

Mike McMahon Extended Learning Track XLT Stock Mastery Course

1 × $31.00

Mike McMahon Extended Learning Track XLT Stock Mastery Course

1 × $31.00 -

×

Two Simple Setups For All Markets (Parts 1, 2, 3) with Rob Hoffman

1 × $31.00

Two Simple Setups For All Markets (Parts 1, 2, 3) with Rob Hoffman

1 × $31.00

5-Week Portfolio (No Bonus) – Criticaltrading

$397.00 Original price was: $397.00.$39.00Current price is: $39.00.

File Size: 1.38 GB

Delivery Time: 1–12 hours

Media Type: Online Course

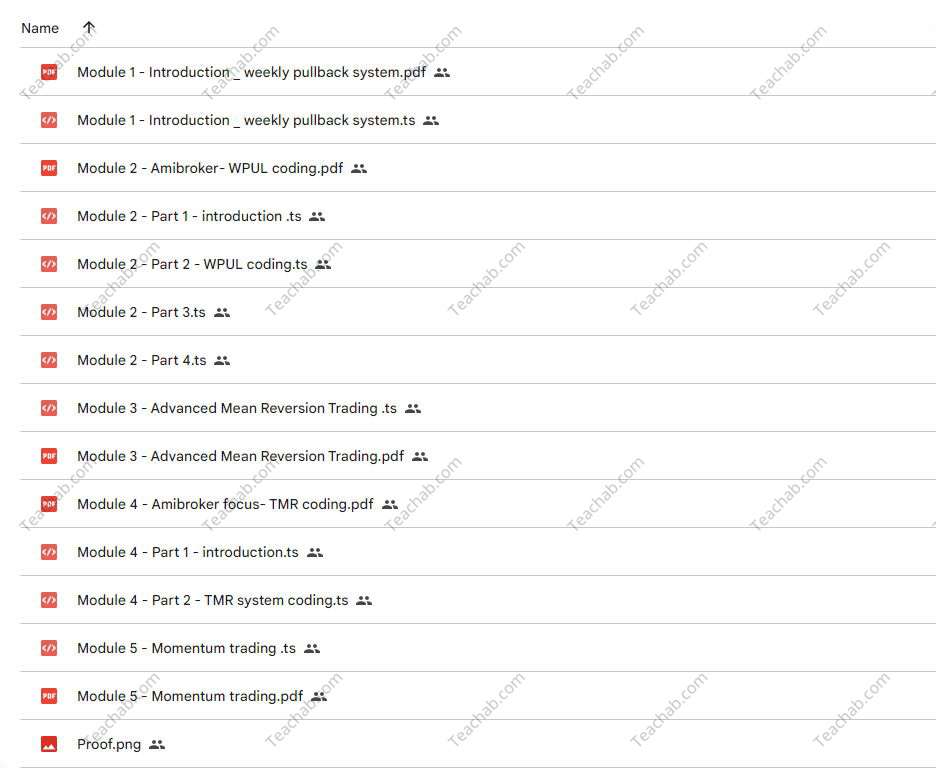

Content Proof: Watch Here!

You may check content proof of “5-Week Portfolio (No Bonus) – Criticaltrading ” below:

Building a 5-Week Portfolio with Criticaltrading: No Bonus, Just Strategy

Introduction

In today’s fast-paced financial environment, creating a robust trading portfolio over a short period, like five weeks, can be challenging yet rewarding. At Criticaltrading, we believe in a straightforward, bonus-free approach to trading that prioritizes clear strategies and market understanding. Let’s explore how you can build a solid 5-week portfolio without relying on bonuses.

What is Criticaltrading?

Criticaltrading is a methodology focused on the essentials of trading: market analysis, risk management, and disciplined execution. This approach strips away the unnecessary frills, such as bonuses, to concentrate on pure trading performance.

Week 1: Establishing the Groundwork

Understanding Market Fundamentals

- Market Research: Begin with in-depth research into market trends and potential sectors for investment. Utilize resources like financial news, market analysis reports, and economic indicators.

- Setting Objectives: Define what you aim to achieve with your portfolio, including your risk tolerance and expected returns.

Planning Your Strategy

- Developing a Trading Plan: Outline your entry and exit strategies. Determine the criteria for choosing investments and the timing for buying and selling.

Week 2: Simulation and Backtesting

Testing Your Strategy

- Simulating Trades: Use trading simulators to test your strategies without financial risk. This step helps refine your approach based on hypothetical outcomes.

- Backtesting: Apply your strategy to historical data to evaluate its effectiveness over past market conditions.

Adjusting the Plan

- Feedback Analysis: Analyze the outcomes of your simulations and backtesting to make necessary adjustments to your strategy.

Week 3: Live Trading with Small Stakes

Entering the Market

- Starting Small: Begin live trading with a small portion of your capital to test your strategy in real-time market conditions.

- Risk Management: Implement strict risk management techniques to minimize losses, such as stop-loss orders and position sizing.

Evaluating Performance

- Performance Review: Regularly review your trading outcomes and compare them to your set objectives. Adjust your approach as needed based on real-world experience.

Week 4: Portfolio Expansion

Scaling Up

- Gradual Increase: If your strategy proves successful, gradually increase your investment stakes to maximize potential returns.

- Diversification: Expand your portfolio by diversifying into different assets or sectors to reduce risk.

Continuous Learning

- Educational Investment: Invest time in continuing your education in trading strategies and market changes. Attend webinars, read books, and participate in forums.

Week 5: Consolidation and Review

Analyzing the Outcome

- Comprehensive Review: At the end of the five weeks, conduct a thorough analysis of your portfolio’s performance. Identify successful strategies and areas for improvement.

- Future Planning: Based on your experiences and outcomes, plan how to proceed with your trading career. Set new goals and strategies for continuous growth.

Conclusion

Building a successful 5-week portfolio with Criticaltrading involves a focused approach to market analysis, strategic planning, and disciplined execution. By avoiding bonuses and concentrating on skills and market behaviors, traders can significantly enhance their trading efficacy.

FAQs

- What is the first step in building a 5-week portfolio?

- The first step is to conduct thorough market research and set clear trading objectives.

- How important is risk management in this short-term trading approach?

- Risk management is crucial as it helps minimize losses and safeguard the portfolio against unexpected market movements.

- Can I expand my portfolio if my strategy is successful in the first few weeks?

- Yes, if your strategy is successful, you can consider gradually increasing your stakes and diversifying your investments.

- What if my initial strategy does not work as expected?

- It’s essential to adjust your strategy based on live trading feedback and simulation results. Continuous learning and adaptation are key.

- How can I ensure continuous improvement in my trading?

- Continuously educate yourself on new trading strategies and market trends, and regularly review and refine your trading plan.

Be the first to review “5-Week Portfolio (No Bonus) – Criticaltrading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.