-

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Traders Edge with Steven Dux

1 × $5.00

Traders Edge with Steven Dux

1 × $5.00 -

×

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00

Guide to Scanning for Potential Stock Trades class with Jeff Bierman

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00

Momentum Mastery with Traderlion Richard Moglen & Ben Bennett

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

7 Days Options Masters Course with John Carter

1 × $54.00

7 Days Options Masters Course with John Carter

1 × $54.00 -

×

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00

Hedges on Hedge Funds: How to Successfully Analyze and Select an Investment with James Hedges

1 × $6.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

Fast Track Course with Tradelikerocket

1 × $233.00

Fast Track Course with Tradelikerocket

1 × $233.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

Starter Guide to Investing Stocks, Crypto & Precious Metals with Ryan Hogue

1 × $5.00

Starter Guide to Investing Stocks, Crypto & Precious Metals with Ryan Hogue

1 × $5.00 -

×

Freedom Challenge Course with Steven Dux

1 × $5.00

Freedom Challenge Course with Steven Dux

1 × $5.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

Evolution Course with Kevin Trades

1 × $15.00

Evolution Course with Kevin Trades

1 × $15.00 -

×

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00

Candlestick and Pivot Point Trading Triggers with John Person

1 × $6.00 -

×

Investing with Exchange Traded Funds Made Easy with Marvin Appel

1 × $6.00

Investing with Exchange Traded Funds Made Easy with Marvin Appel

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The McClellan Oscillator and Other Tools for with Tom McClellan

1 × $6.00

The McClellan Oscillator and Other Tools for with Tom McClellan

1 × $6.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00 -

×

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00

A Litle Keltner, a Litle Wycoff and of lot of Street Smarts with Linda Raschke

1 × $6.00 -

×

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00 -

×

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00

ProfileTraders - Swing and Price Analysis (May 2014)

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Trading Aplications of Japanese Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

Andy’s EMini Bar – 40 Min System with Joe Ross

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

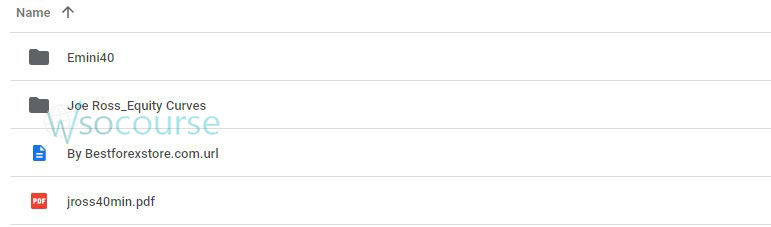

You may check content proof of “Andy’s EMini Bar – 40 Min System with Joe Ross” below:

Andy’s EMini Bar – 40 Min System with Joe Ross

Introduction to Andy’s EMini Bar – 40 Min System

Investing in the stock market requires strategies that can maximize profits while minimizing risks. Andy’s EMini Bar – 40 Min System with Joe Ross offers a robust method for traders aiming for consistent returns.

Who is Joe Ross?

Joe Ross is a renowned trader and educator with decades of experience in the financial markets. His systems and strategies have helped countless traders achieve their financial goals.

Understanding the EMini Bar

What is the EMini Bar?

The EMini Bar is a specific type of trading bar used in this system to identify potential trade opportunities. It provides clear signals based on price movements within a 40-minute timeframe.

Why 40 Minutes?

A 40-minute bar strikes a balance between too short and too long trading intervals, allowing traders to make timely and informed decisions without the noise of shorter timeframes.

Setting Up the System

Tools You Need

- Trading Platform: A reliable trading platform that supports bar charting.

- Indicators: Specific indicators recommended by Joe Ross for accurate signal detection.

Configuring the EMini Bar

To set up the EMini Bar on your trading platform:

- Select the 40-minute timeframe.

- Apply Joe Ross’s recommended indicators.

- Customize your chart to highlight EMini Bars.

The Trading Strategy

Entry Points

Identify entry points based on the formation of the EMini Bar. Joe Ross emphasizes the importance of waiting for a complete bar to form before making a trade decision.

Exit Strategy

Having a clear exit strategy is crucial. The system includes predefined exit points to protect your capital and lock in profits.

Risk Management

Setting Stop-Loss

Joe Ross advocates for a disciplined approach to risk management. Set your stop-loss at a level that minimizes potential losses while allowing room for the trade to develop.

Position Sizing

Determine the appropriate position size based on your risk tolerance and account size. This helps in managing your overall exposure.

Benefits of Andy’s EMini Bar – 40 Min System

Consistency

The 40-minute timeframe provides consistent opportunities without overwhelming traders with constant signals.

Flexibility

This system is versatile and can be adapted to various market conditions, making it a valuable tool for both novice and experienced traders.

Simplicity

Joe Ross’s system is straightforward, making it accessible to traders at all levels.

Implementing the System

Backtesting

Before going live, backtest the system on historical data to understand its performance and make necessary adjustments.

Paper Trading

Practice with paper trading to get a feel of the system in real-time without risking actual capital.

Real-Life Application

Success Stories

Many traders have reported success using Andy’s EMini Bar – 40 Min System, attributing their consistency in the market to Joe Ross’s teachings.

Common Challenges

Some common challenges include adhering to the system rules and managing emotional responses during trades.

Advanced Tips

Combining with Other Strategies

For enhanced performance, consider combining Andy’s EMini Bar with other complementary trading strategies.

Continuous Learning

Stay updated with Joe Ross’s latest insights and market analysis to refine your trading approach.

Conclusion

Andy’s EMini Bar – 40 Min System with Joe Ross is a powerful tool for traders seeking a reliable and straightforward trading strategy. By following Joe Ross’s guidelines, you can enhance your trading skills and achieve consistent results.

FAQs

1. What is the main advantage of the 40-minute timeframe?

The 40-minute timeframe strikes a balance between short-term and long-term trading, offering frequent opportunities without the noise of shorter intervals.

2. Can beginners use this system?

Yes, Joe Ross’s system is designed to be accessible to traders at all levels, including beginners.

3. How important is backtesting?

Backtesting is crucial as it helps you understand the system’s performance on historical data and make necessary adjustments before trading live.

4. What platforms support the EMini Bar setup?

Most major trading platforms support the setup required for Andy’s EMini Bar. Ensure your platform allows for custom timeframes and indicators.

5. How can I stay updated with Joe Ross’s latest strategies?

Follow Joe Ross’s publications, attend his webinars, and participate in trading forums to stay informed about his latest insights.

Be the first to review “Andy’s EMini Bar – 40 Min System with Joe Ross” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.