-

×

Kaizen Pipsology: Forex Mentorship

1 × $8.00

Kaizen Pipsology: Forex Mentorship

1 × $8.00 -

×

Trading Calendar Spreads with Option Pit

1 × $39.00

Trading Calendar Spreads with Option Pit

1 × $39.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Gaining Option Leverage: Using Market Makers Tactics with Jon Najarian

1 × $4.00

Gaining Option Leverage: Using Market Makers Tactics with Jon Najarian

1 × $4.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

The Volatility Surface with Jim Gatheral

1 × $6.00

The Volatility Surface with Jim Gatheral

1 × $6.00 -

×

AutoTrader-Fully Automated Trading System with Trading123

1 × $46.00

AutoTrader-Fully Automated Trading System with Trading123

1 × $46.00 -

×

The Power of Position Sizing Strategies SQN Secrets Revealed with Van Tharp

1 × $5.00

The Power of Position Sizing Strategies SQN Secrets Revealed with Van Tharp

1 × $5.00 -

×

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00

Superleverage The Only Sensible Way to Speculate with Steve Sarnoff

1 × $6.00 -

×

Elite Keys to Trading Success Class

1 × $23.00

Elite Keys to Trading Success Class

1 × $23.00 -

×

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

The Global Money Markets with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00

The Global Money Markets with Frank Fabozzi, Steven Mann & Moorad Choudhry

1 × $6.00 -

×

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00

ND10X - 10X Your Money In 10 Days with Nicola Delic

1 × $23.00 -

×

Simpler Options - Stock Trading Patterns

1 × $6.00

Simpler Options - Stock Trading Patterns

1 × $6.00 -

×

Six Setups Using Ichimoku Kinkō Hyō with Alphashark

1 × $15.00

Six Setups Using Ichimoku Kinkō Hyō with Alphashark

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00 -

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

The Vol.T Volume-Tick Indicator Package

1 × $23.00

The Vol.T Volume-Tick Indicator Package

1 × $23.00 -

×

WickOrTreat Trading Course with WickOrTreat

1 × $6.00

WickOrTreat Trading Course with WickOrTreat

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Telecoms Trade War with Mark Naftel

1 × $6.00

The Telecoms Trade War with Mark Naftel

1 × $6.00 -

×

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00

Rockwell Trading - Money Management - 2 DVDs

1 × $6.00 -

×

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00

Statistics of Extremes: Theory and Applications with Jan Beirlant, Yuri Goegebeur, Jozef Teugels & Johan Segers

1 × $6.00 -

×

Jtrader - A+ Setups Small Caps

1 × $23.00

Jtrader - A+ Setups Small Caps

1 × $23.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00

Wave Trading Masterclass: Elliott's Wave Theory/Fibonacci Principles with Wave Trader

1 × $116.00 -

×

Fixed-Income Securities: Valuation, Risk Management and Portfolio Strategies - Lionel Martellini, Philippe Priaulet & Stéphane Priaulet

1 × $6.00

Fixed-Income Securities: Valuation, Risk Management and Portfolio Strategies - Lionel Martellini, Philippe Priaulet & Stéphane Priaulet

1 × $6.00 -

×

MLT Divergence Indicator with Major League Trading

1 × $23.00

MLT Divergence Indicator with Major League Trading

1 × $23.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00 -

×

Tracking & Kalman Filtering Made Easy with Eli Brookner

1 × $6.00

Tracking & Kalman Filtering Made Easy with Eli Brookner

1 × $6.00 -

×

Freak Forex Technicals with Ken FX Freak

1 × $6.00

Freak Forex Technicals with Ken FX Freak

1 × $6.00 -

×

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

FTMO Academy Course

1 × $5.00

FTMO Academy Course

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Introduction to Futures & Options Markets (2nd Ed.)

1 × $6.00

Introduction to Futures & Options Markets (2nd Ed.)

1 × $6.00 -

×

The EAP Training Program (Apr 2019)

1 × $6.00

The EAP Training Program (Apr 2019)

1 × $6.00 -

×

Binary Defender

1 × $15.00

Binary Defender

1 × $15.00 -

×

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00

Trading Connors VIX Reversals Tradestation Files with Laurence A. Connors & Gregory J. Che

1 × $6.00 -

×

Dan Sheridan Butterfly Course (Sep 2012)

1 × $6.00

Dan Sheridan Butterfly Course (Sep 2012)

1 × $6.00 -

×

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Forex Trading: Comprehensive & Concise Forex Trading Course with Luciano Kelly & Learn Forex Mentor

1 × $6.00

Forex Trading: Comprehensive & Concise Forex Trading Course with Luciano Kelly & Learn Forex Mentor

1 × $6.00 -

×

4D Bootcamp with Black Rabbit

1 × $10.00

4D Bootcamp with Black Rabbit

1 × $10.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00 -

×

SOT Advanced Course (May 2014)

1 × $23.00

SOT Advanced Course (May 2014)

1 × $23.00 -

×

Nasdaq Trading Strategies Book with French Trader

1 × $6.00

Nasdaq Trading Strategies Book with French Trader

1 × $6.00 -

×

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00

Peak Capital Trading Bootcamp with Andrew Aziz

1 × $5.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00 -

×

Analysis of Equity Investments: Valuation with John Stowe, Thomas Robinson, Jerald Pinto & Dennis McLeavey

1 × $6.00

Analysis of Equity Investments: Valuation with John Stowe, Thomas Robinson, Jerald Pinto & Dennis McLeavey

1 × $6.00 -

×

Scalping Master Course with Dayonetraders

1 × $6.00

Scalping Master Course with Dayonetraders

1 × $6.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00

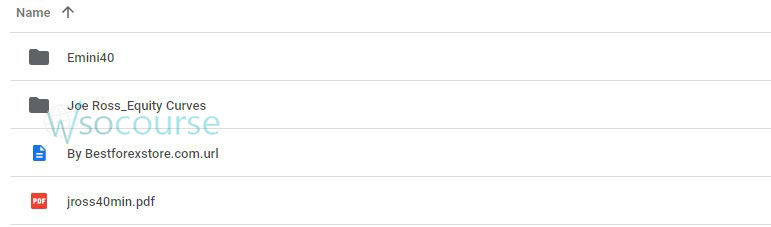

Andy’s EMini Bar – 40 Min System with Joe Ross

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Andy’s EMini Bar – 40 Min System with Joe Ross” below:

Andy’s EMini Bar – 40 Min System with Joe Ross

Introduction to Andy’s EMini Bar – 40 Min System

Investing in the stock market requires strategies that can maximize profits while minimizing risks. Andy’s EMini Bar – 40 Min System with Joe Ross offers a robust method for traders aiming for consistent returns.

Who is Joe Ross?

Joe Ross is a renowned trader and educator with decades of experience in the financial markets. His systems and strategies have helped countless traders achieve their financial goals.

Understanding the EMini Bar

What is the EMini Bar?

The EMini Bar is a specific type of trading bar used in this system to identify potential trade opportunities. It provides clear signals based on price movements within a 40-minute timeframe.

Why 40 Minutes?

A 40-minute bar strikes a balance between too short and too long trading intervals, allowing traders to make timely and informed decisions without the noise of shorter timeframes.

Setting Up the System

Tools You Need

- Trading Platform: A reliable trading platform that supports bar charting.

- Indicators: Specific indicators recommended by Joe Ross for accurate signal detection.

Configuring the EMini Bar

To set up the EMini Bar on your trading platform:

- Select the 40-minute timeframe.

- Apply Joe Ross’s recommended indicators.

- Customize your chart to highlight EMini Bars.

The Trading Strategy

Entry Points

Identify entry points based on the formation of the EMini Bar. Joe Ross emphasizes the importance of waiting for a complete bar to form before making a trade decision.

Exit Strategy

Having a clear exit strategy is crucial. The system includes predefined exit points to protect your capital and lock in profits.

Risk Management

Setting Stop-Loss

Joe Ross advocates for a disciplined approach to risk management. Set your stop-loss at a level that minimizes potential losses while allowing room for the trade to develop.

Position Sizing

Determine the appropriate position size based on your risk tolerance and account size. This helps in managing your overall exposure.

Benefits of Andy’s EMini Bar – 40 Min System

Consistency

The 40-minute timeframe provides consistent opportunities without overwhelming traders with constant signals.

Flexibility

This system is versatile and can be adapted to various market conditions, making it a valuable tool for both novice and experienced traders.

Simplicity

Joe Ross’s system is straightforward, making it accessible to traders at all levels.

Implementing the System

Backtesting

Before going live, backtest the system on historical data to understand its performance and make necessary adjustments.

Paper Trading

Practice with paper trading to get a feel of the system in real-time without risking actual capital.

Real-Life Application

Success Stories

Many traders have reported success using Andy’s EMini Bar – 40 Min System, attributing their consistency in the market to Joe Ross’s teachings.

Common Challenges

Some common challenges include adhering to the system rules and managing emotional responses during trades.

Advanced Tips

Combining with Other Strategies

For enhanced performance, consider combining Andy’s EMini Bar with other complementary trading strategies.

Continuous Learning

Stay updated with Joe Ross’s latest insights and market analysis to refine your trading approach.

Conclusion

Andy’s EMini Bar – 40 Min System with Joe Ross is a powerful tool for traders seeking a reliable and straightforward trading strategy. By following Joe Ross’s guidelines, you can enhance your trading skills and achieve consistent results.

FAQs

1. What is the main advantage of the 40-minute timeframe?

The 40-minute timeframe strikes a balance between short-term and long-term trading, offering frequent opportunities without the noise of shorter intervals.

2. Can beginners use this system?

Yes, Joe Ross’s system is designed to be accessible to traders at all levels, including beginners.

3. How important is backtesting?

Backtesting is crucial as it helps you understand the system’s performance on historical data and make necessary adjustments before trading live.

4. What platforms support the EMini Bar setup?

Most major trading platforms support the setup required for Andy’s EMini Bar. Ensure your platform allows for custom timeframes and indicators.

5. How can I stay updated with Joe Ross’s latest strategies?

Follow Joe Ross’s publications, attend his webinars, and participate in trading forums to stay informed about his latest insights.

Be the first to review “Andy’s EMini Bar – 40 Min System with Joe Ross” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.