-

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00

HEDGED STRATEGY SERIES IN VOLATILE MARKETS – HEDGED CREDIT SPREADS - Dan Sheridan

1 × $6.00 -

×

MMfx Course August 2011 + MT4 Ind. Jan 2012

1 × $15.00

MMfx Course August 2011 + MT4 Ind. Jan 2012

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00 -

×

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00

Astro Gann Charting Software Wave59 V 3.6

1 × $6.00 -

×

Small and Mighty Association with Ryan Lee

1 × $6.00

Small and Mighty Association with Ryan Lee

1 × $6.00 -

×

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00

Advanced Trading Course - Footprint Charts, Market Profile & TPO with Jayson Casper

1 × $31.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Advanced Group Analysis Turorial with David Vomund

1 × $6.00

Advanced Group Analysis Turorial with David Vomund

1 × $6.00 -

×

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00

The Handbook of Chaos Control with H.G.Schuster

1 × $6.00 -

×

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00

EZ2 Trade Charting Collection eSignal (ez2tradesoftware.com) - Raghee Horner

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00

Day Trading Options Guide PDF with Matt Diamond

1 × $23.00 -

×

All About Mutual Funds with Bruce Jacobs

1 × $6.00

All About Mutual Funds with Bruce Jacobs

1 × $6.00 -

×

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00

Asset Prices, Booms & Recessions (2nd Ed.) with Willi Semmler

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00

Creating the Optimal Trade for Explosive Profits with George A.Fontanills

1 × $6.00 -

×

Hit & Run Trading: The Short-Term Stock Traders Bible (1996) with Jeff Cooper

1 × $6.00

Hit & Run Trading: The Short-Term Stock Traders Bible (1996) with Jeff Cooper

1 × $6.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00 -

×

Art & Science of Trend Trading Class with Jeff Bierman

1 × $6.00

Art & Science of Trend Trading Class with Jeff Bierman

1 × $6.00 -

×

What Products to Watch and Why Class with Don Kaufman

1 × $6.00

What Products to Watch and Why Class with Don Kaufman

1 × $6.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

Stable Adaptive Control for Nonlinear Systems with Jeffrey Spooner

1 × $6.00

Stable Adaptive Control for Nonlinear Systems with Jeffrey Spooner

1 × $6.00 -

×

Simple Forex Profits with Rayy Bannzz

1 × $31.00

Simple Forex Profits with Rayy Bannzz

1 × $31.00 -

×

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00

Fundamentals of Futures & Options Markets (4th Ed.)

1 × $6.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00

Quantifiable Edges – Gold Subscription with Rob Hanna

1 × $54.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The 10 Essentials of Forex Trading with Jared Martinez

1 × $6.00

The 10 Essentials of Forex Trading with Jared Martinez

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00

Picking the Best Stocks & Strategies for every Option Trade with James Bittman

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

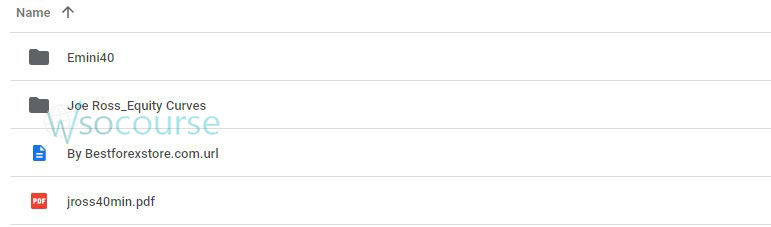

Content Proof: Watch Here!

You may check content proof of “Andy’s EMini Bar – 40 Min System with Joe Ross” below:

Andy’s EMini Bar – 40 Min System with Joe Ross

Introduction to Andy’s EMini Bar – 40 Min System

Investing in the stock market requires strategies that can maximize profits while minimizing risks. Andy’s EMini Bar – 40 Min System with Joe Ross offers a robust method for traders aiming for consistent returns.

Who is Joe Ross?

Joe Ross is a renowned trader and educator with decades of experience in the financial markets. His systems and strategies have helped countless traders achieve their financial goals.

Understanding the EMini Bar

What is the EMini Bar?

The EMini Bar is a specific type of trading bar used in this system to identify potential trade opportunities. It provides clear signals based on price movements within a 40-minute timeframe.

Why 40 Minutes?

A 40-minute bar strikes a balance between too short and too long trading intervals, allowing traders to make timely and informed decisions without the noise of shorter timeframes.

Setting Up the System

Tools You Need

- Trading Platform: A reliable trading platform that supports bar charting.

- Indicators: Specific indicators recommended by Joe Ross for accurate signal detection.

Configuring the EMini Bar

To set up the EMini Bar on your trading platform:

- Select the 40-minute timeframe.

- Apply Joe Ross’s recommended indicators.

- Customize your chart to highlight EMini Bars.

The Trading Strategy

Entry Points

Identify entry points based on the formation of the EMini Bar. Joe Ross emphasizes the importance of waiting for a complete bar to form before making a trade decision.

Exit Strategy

Having a clear exit strategy is crucial. The system includes predefined exit points to protect your capital and lock in profits.

Risk Management

Setting Stop-Loss

Joe Ross advocates for a disciplined approach to risk management. Set your stop-loss at a level that minimizes potential losses while allowing room for the trade to develop.

Position Sizing

Determine the appropriate position size based on your risk tolerance and account size. This helps in managing your overall exposure.

Benefits of Andy’s EMini Bar – 40 Min System

Consistency

The 40-minute timeframe provides consistent opportunities without overwhelming traders with constant signals.

Flexibility

This system is versatile and can be adapted to various market conditions, making it a valuable tool for both novice and experienced traders.

Simplicity

Joe Ross’s system is straightforward, making it accessible to traders at all levels.

Implementing the System

Backtesting

Before going live, backtest the system on historical data to understand its performance and make necessary adjustments.

Paper Trading

Practice with paper trading to get a feel of the system in real-time without risking actual capital.

Real-Life Application

Success Stories

Many traders have reported success using Andy’s EMini Bar – 40 Min System, attributing their consistency in the market to Joe Ross’s teachings.

Common Challenges

Some common challenges include adhering to the system rules and managing emotional responses during trades.

Advanced Tips

Combining with Other Strategies

For enhanced performance, consider combining Andy’s EMini Bar with other complementary trading strategies.

Continuous Learning

Stay updated with Joe Ross’s latest insights and market analysis to refine your trading approach.

Conclusion

Andy’s EMini Bar – 40 Min System with Joe Ross is a powerful tool for traders seeking a reliable and straightforward trading strategy. By following Joe Ross’s guidelines, you can enhance your trading skills and achieve consistent results.

FAQs

1. What is the main advantage of the 40-minute timeframe?

The 40-minute timeframe strikes a balance between short-term and long-term trading, offering frequent opportunities without the noise of shorter intervals.

2. Can beginners use this system?

Yes, Joe Ross’s system is designed to be accessible to traders at all levels, including beginners.

3. How important is backtesting?

Backtesting is crucial as it helps you understand the system’s performance on historical data and make necessary adjustments before trading live.

4. What platforms support the EMini Bar setup?

Most major trading platforms support the setup required for Andy’s EMini Bar. Ensure your platform allows for custom timeframes and indicators.

5. How can I stay updated with Joe Ross’s latest strategies?

Follow Joe Ross’s publications, attend his webinars, and participate in trading forums to stay informed about his latest insights.

Be the first to review “Andy’s EMini Bar – 40 Min System with Joe Ross” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.