-

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00

The Handbook of Pairs Trading with Douglas Ehrman

1 × $6.00 -

×

CFA Level 2 - Sample Item Sets 2003

1 × $6.00

CFA Level 2 - Sample Item Sets 2003

1 × $6.00 -

×

Naked Trading Mastery

1 × $39.00

Naked Trading Mastery

1 × $39.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00 -

×

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00 -

×

How To Trade The Rick Burgess Triple-Thrust Momentum Method with Rick Burgess

1 × $6.00

How To Trade The Rick Burgess Triple-Thrust Momentum Method with Rick Burgess

1 × $6.00 -

×

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00

Practical Approach to Ninjatrader 8 Platform with Rajandran R

1 × $6.00 -

×

HYDRA 3 Day Bootcamp

1 × $5.00

HYDRA 3 Day Bootcamp

1 × $5.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

The Litle Book of Bulletproof Investing

1 × $6.00

The Litle Book of Bulletproof Investing

1 × $6.00 -

×

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00 -

×

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00 -

×

News Profiteer System Manual & Members Area Videos with Henry Liu

1 × $6.00

News Profiteer System Manual & Members Area Videos with Henry Liu

1 × $6.00 -

×

Raghee’s Winners Circle Course

1 × $6.00

Raghee’s Winners Circle Course

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Level II Trading Warfare - The Undergroundtrader's Powerful Weapons for Winning - Jea Yu

1 × $6.00

Level II Trading Warfare - The Undergroundtrader's Powerful Weapons for Winning - Jea Yu

1 × $6.00 -

×

CFA Level 3 - Examination Morning Session – Essay (2002)

1 × $6.00

CFA Level 3 - Examination Morning Session – Essay (2002)

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

BD FX Course with FX Learning

1 × $6.00

BD FX Course with FX Learning

1 × $6.00 -

×

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00 -

×

Selected Articles by the Late by George Lindsay

1 × $6.00

Selected Articles by the Late by George Lindsay

1 × $6.00 -

×

Mastering Fundamental Analysis with Michael Thomsett

1 × $6.00

Mastering Fundamental Analysis with Michael Thomsett

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

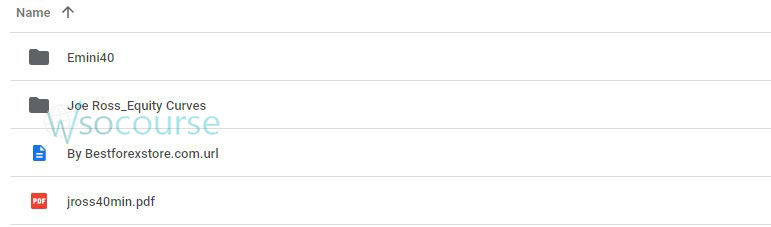

Andy’s EMini Bar – 40 Min System with Joe Ross

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Andy’s EMini Bar – 40 Min System with Joe Ross” below:

Andy’s EMini Bar – 40 Min System with Joe Ross

Introduction to Andy’s EMini Bar – 40 Min System

Investing in the stock market requires strategies that can maximize profits while minimizing risks. Andy’s EMini Bar – 40 Min System with Joe Ross offers a robust method for traders aiming for consistent returns.

Who is Joe Ross?

Joe Ross is a renowned trader and educator with decades of experience in the financial markets. His systems and strategies have helped countless traders achieve their financial goals.

Understanding the EMini Bar

What is the EMini Bar?

The EMini Bar is a specific type of trading bar used in this system to identify potential trade opportunities. It provides clear signals based on price movements within a 40-minute timeframe.

Why 40 Minutes?

A 40-minute bar strikes a balance between too short and too long trading intervals, allowing traders to make timely and informed decisions without the noise of shorter timeframes.

Setting Up the System

Tools You Need

- Trading Platform: A reliable trading platform that supports bar charting.

- Indicators: Specific indicators recommended by Joe Ross for accurate signal detection.

Configuring the EMini Bar

To set up the EMini Bar on your trading platform:

- Select the 40-minute timeframe.

- Apply Joe Ross’s recommended indicators.

- Customize your chart to highlight EMini Bars.

The Trading Strategy

Entry Points

Identify entry points based on the formation of the EMini Bar. Joe Ross emphasizes the importance of waiting for a complete bar to form before making a trade decision.

Exit Strategy

Having a clear exit strategy is crucial. The system includes predefined exit points to protect your capital and lock in profits.

Risk Management

Setting Stop-Loss

Joe Ross advocates for a disciplined approach to risk management. Set your stop-loss at a level that minimizes potential losses while allowing room for the trade to develop.

Position Sizing

Determine the appropriate position size based on your risk tolerance and account size. This helps in managing your overall exposure.

Benefits of Andy’s EMini Bar – 40 Min System

Consistency

The 40-minute timeframe provides consistent opportunities without overwhelming traders with constant signals.

Flexibility

This system is versatile and can be adapted to various market conditions, making it a valuable tool for both novice and experienced traders.

Simplicity

Joe Ross’s system is straightforward, making it accessible to traders at all levels.

Implementing the System

Backtesting

Before going live, backtest the system on historical data to understand its performance and make necessary adjustments.

Paper Trading

Practice with paper trading to get a feel of the system in real-time without risking actual capital.

Real-Life Application

Success Stories

Many traders have reported success using Andy’s EMini Bar – 40 Min System, attributing their consistency in the market to Joe Ross’s teachings.

Common Challenges

Some common challenges include adhering to the system rules and managing emotional responses during trades.

Advanced Tips

Combining with Other Strategies

For enhanced performance, consider combining Andy’s EMini Bar with other complementary trading strategies.

Continuous Learning

Stay updated with Joe Ross’s latest insights and market analysis to refine your trading approach.

Conclusion

Andy’s EMini Bar – 40 Min System with Joe Ross is a powerful tool for traders seeking a reliable and straightforward trading strategy. By following Joe Ross’s guidelines, you can enhance your trading skills and achieve consistent results.

FAQs

1. What is the main advantage of the 40-minute timeframe?

The 40-minute timeframe strikes a balance between short-term and long-term trading, offering frequent opportunities without the noise of shorter intervals.

2. Can beginners use this system?

Yes, Joe Ross’s system is designed to be accessible to traders at all levels, including beginners.

3. How important is backtesting?

Backtesting is crucial as it helps you understand the system’s performance on historical data and make necessary adjustments before trading live.

4. What platforms support the EMini Bar setup?

Most major trading platforms support the setup required for Andy’s EMini Bar. Ensure your platform allows for custom timeframes and indicators.

5. How can I stay updated with Joe Ross’s latest strategies?

Follow Joe Ross’s publications, attend his webinars, and participate in trading forums to stay informed about his latest insights.

Be the first to review “Andy’s EMini Bar – 40 Min System with Joe Ross” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.