-

×

Stock Trader`s Almanac 2012 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Trader`s Almanac 2012 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

Winning With The Market with Douglas R.Sease

1 × $6.00

Winning With The Market with Douglas R.Sease

1 × $6.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

Blueprint to Extreme Reversals with Aiman Almansoori - Trading Terminal

1 × $8.00

Blueprint to Extreme Reversals with Aiman Almansoori - Trading Terminal

1 × $8.00 -

×

Market Making Scalping Manual with Gary Norden - Jigsaw Trading

1 × $69.00

Market Making Scalping Manual with Gary Norden - Jigsaw Trading

1 × $69.00 -

×

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00

SJG Trading - Butterflies Class with Steve Ganz

1 × $31.00 -

×

Advanced Gap Trading Strategies with Master Trader

1 × $31.00

Advanced Gap Trading Strategies with Master Trader

1 × $31.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00 -

×

NASDAQ Level II Trading Strategies

1 × $6.00

NASDAQ Level II Trading Strategies

1 × $6.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

4 Day Trading Bootcamp

1 × $31.00

4 Day Trading Bootcamp

1 × $31.00 -

×

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00 -

×

Onyx Platinum Trading Accelerator 2.0 with Nick Deflorio

1 × $6.00

Onyx Platinum Trading Accelerator 2.0 with Nick Deflorio

1 × $6.00 -

×

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00

Tharp Think Essentials Video Workshop with Van Tharp

1 × $5.00 -

×

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00

A Day In The Life Of A Forex Trader with Vic Noble & Shirley Hudson

1 × $23.00 -

×

How To Invest Better

1 × $6.00

How To Invest Better

1 × $6.00 -

×

Profitable DayTrading with Precision - George Angell

1 × $6.00

Profitable DayTrading with Precision - George Angell

1 × $6.00 -

×

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00

Fierce 10 On Demand Coaching Program with High Performance Trading

1 × $5.00 -

×

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00

OFA - Intensive Boot Camp 5 Day Course

1 × $6.00 -

×

Stock Patterns for DayTrading. Home Study Course

1 × $6.00

Stock Patterns for DayTrading. Home Study Course

1 × $6.00 -

×

Restore Soul Fragments (Advanced) by Spirituality Zone

1 × $15.40

Restore Soul Fragments (Advanced) by Spirituality Zone

1 × $15.40 -

×

Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders - James Bickford

1 × $6.00

Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders - James Bickford

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Dynamic Time Cycles with Peter Eliades

1 × $6.00

Dynamic Time Cycles with Peter Eliades

1 × $6.00 -

×

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00

Psychology of the Stock Market (1912) with G.C.Selden

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00 -

×

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00 -

×

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

TraderSumo Academy Course

1 × $13.00

TraderSumo Academy Course

1 × $13.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00

3 Day Live Trading Webinar (Jan 2010)

1 × $6.00 -

×

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00

Detecting Trend Direction & Strength (Article) with Barbara Star

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00

Simpler Traders - Ultimate Guide to Debit Spreads (PREMIUM)

1 × $39.00 -

×

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00 -

×

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00 -

×

Acclimation Course with Base Camp Trading

1 × $10.00

Acclimation Course with Base Camp Trading

1 × $10.00 -

×

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00 -

×

Full Members Area (Icludes 2006 Seminar & Webinars) with Tom Yeomans

1 × $6.00

Full Members Area (Icludes 2006 Seminar & Webinars) with Tom Yeomans

1 × $6.00 -

×

FXjake Daily Trader Program

1 × $31.00

FXjake Daily Trader Program

1 × $31.00 -

×

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00 -

×

Matrix Options

1 × $6.00

Matrix Options

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00 -

×

Investment Leadership & Portfolio Management with Brian Singer

1 × $6.00

Investment Leadership & Portfolio Management with Brian Singer

1 × $6.00 -

×

Secrets to Short Term Trading with Larry Williams

1 × $6.00

Secrets to Short Term Trading with Larry Williams

1 × $6.00 -

×

PPC Lead Pro Training Program

1 × $31.00

PPC Lead Pro Training Program

1 × $31.00 -

×

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00

Sacredscience - W.F.Whitehead – Occultism Simplified

1 × $6.00 -

×

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00

7 Steps to Success Trading Options Online with Larry Spears

1 × $4.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00

Andy’s EMini Bar – 40 Min System with Joe Ross

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

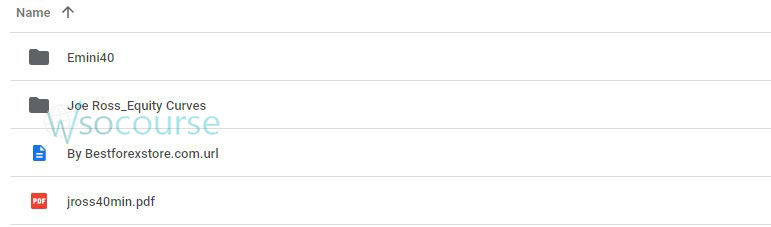

Content Proof: Watch Here!

You may check content proof of “Andy’s EMini Bar – 40 Min System with Joe Ross” below:

Andy’s EMini Bar – 40 Min System with Joe Ross

Introduction to Andy’s EMini Bar – 40 Min System

Investing in the stock market requires strategies that can maximize profits while minimizing risks. Andy’s EMini Bar – 40 Min System with Joe Ross offers a robust method for traders aiming for consistent returns.

Who is Joe Ross?

Joe Ross is a renowned trader and educator with decades of experience in the financial markets. His systems and strategies have helped countless traders achieve their financial goals.

Understanding the EMini Bar

What is the EMini Bar?

The EMini Bar is a specific type of trading bar used in this system to identify potential trade opportunities. It provides clear signals based on price movements within a 40-minute timeframe.

Why 40 Minutes?

A 40-minute bar strikes a balance between too short and too long trading intervals, allowing traders to make timely and informed decisions without the noise of shorter timeframes.

Setting Up the System

Tools You Need

- Trading Platform: A reliable trading platform that supports bar charting.

- Indicators: Specific indicators recommended by Joe Ross for accurate signal detection.

Configuring the EMini Bar

To set up the EMini Bar on your trading platform:

- Select the 40-minute timeframe.

- Apply Joe Ross’s recommended indicators.

- Customize your chart to highlight EMini Bars.

The Trading Strategy

Entry Points

Identify entry points based on the formation of the EMini Bar. Joe Ross emphasizes the importance of waiting for a complete bar to form before making a trade decision.

Exit Strategy

Having a clear exit strategy is crucial. The system includes predefined exit points to protect your capital and lock in profits.

Risk Management

Setting Stop-Loss

Joe Ross advocates for a disciplined approach to risk management. Set your stop-loss at a level that minimizes potential losses while allowing room for the trade to develop.

Position Sizing

Determine the appropriate position size based on your risk tolerance and account size. This helps in managing your overall exposure.

Benefits of Andy’s EMini Bar – 40 Min System

Consistency

The 40-minute timeframe provides consistent opportunities without overwhelming traders with constant signals.

Flexibility

This system is versatile and can be adapted to various market conditions, making it a valuable tool for both novice and experienced traders.

Simplicity

Joe Ross’s system is straightforward, making it accessible to traders at all levels.

Implementing the System

Backtesting

Before going live, backtest the system on historical data to understand its performance and make necessary adjustments.

Paper Trading

Practice with paper trading to get a feel of the system in real-time without risking actual capital.

Real-Life Application

Success Stories

Many traders have reported success using Andy’s EMini Bar – 40 Min System, attributing their consistency in the market to Joe Ross’s teachings.

Common Challenges

Some common challenges include adhering to the system rules and managing emotional responses during trades.

Advanced Tips

Combining with Other Strategies

For enhanced performance, consider combining Andy’s EMini Bar with other complementary trading strategies.

Continuous Learning

Stay updated with Joe Ross’s latest insights and market analysis to refine your trading approach.

Conclusion

Andy’s EMini Bar – 40 Min System with Joe Ross is a powerful tool for traders seeking a reliable and straightforward trading strategy. By following Joe Ross’s guidelines, you can enhance your trading skills and achieve consistent results.

FAQs

1. What is the main advantage of the 40-minute timeframe?

The 40-minute timeframe strikes a balance between short-term and long-term trading, offering frequent opportunities without the noise of shorter intervals.

2. Can beginners use this system?

Yes, Joe Ross’s system is designed to be accessible to traders at all levels, including beginners.

3. How important is backtesting?

Backtesting is crucial as it helps you understand the system’s performance on historical data and make necessary adjustments before trading live.

4. What platforms support the EMini Bar setup?

Most major trading platforms support the setup required for Andy’s EMini Bar. Ensure your platform allows for custom timeframes and indicators.

5. How can I stay updated with Joe Ross’s latest strategies?

Follow Joe Ross’s publications, attend his webinars, and participate in trading forums to stay informed about his latest insights.

Be the first to review “Andy’s EMini Bar – 40 Min System with Joe Ross” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.