-

×

Hedge Fund Trading Systems with Trading Tuitions

1 × $5.00

Hedge Fund Trading Systems with Trading Tuitions

1 × $5.00 -

×

GTA Professional Course with Gova Trading Academy

1 × $5.00

GTA Professional Course with Gova Trading Academy

1 × $5.00 -

×

How To Win 97% Of Your Options Trader with Jeff Tompkins

1 × $6.00

How To Win 97% Of Your Options Trader with Jeff Tompkins

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trade Your Way to Wealth with Bill Kraft

1 × $6.00

Trade Your Way to Wealth with Bill Kraft

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading System Building Blocks with John Hill

1 × $6.00

Trading System Building Blocks with John Hill

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Mastering Momentum Gaps with Toni Hansen

1 × $6.00

Mastering Momentum Gaps with Toni Hansen

1 × $6.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

JeaFx 2023 with James Allen

1 × $5.00

JeaFx 2023 with James Allen

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Area 61 with BCFX

1 × $6.00

Area 61 with BCFX

1 × $6.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00 -

×

Get More Leads Quickly with Brittany Lynch

1 × $6.00

Get More Leads Quickly with Brittany Lynch

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00

Quantitative Finance & Algorithmic Trading II - Time Series with Holczer Balazs

1 × $4.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Professional Trader Training Course (Complete)

1 × $23.00

Professional Trader Training Course (Complete)

1 × $23.00 -

×

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00 -

×

Guide to Winning with Automated Trading Systems with Jack Schwager

1 × $6.00

Guide to Winning with Automated Trading Systems with Jack Schwager

1 × $6.00 -

×

WealthFRX Trading Mastery 3.0

1 × $5.00

WealthFRX Trading Mastery 3.0

1 × $5.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00 -

×

Trading by the Minute - Joe Ross

1 × $6.00

Trading by the Minute - Joe Ross

1 × $6.00 -

×

Intra-Day Trading Techniques DVD with Greg Capra

1 × $6.00

Intra-Day Trading Techniques DVD with Greg Capra

1 × $6.00 -

×

How to Collect Income Being Short with Don Kaufman

1 × $6.00

How to Collect Income Being Short with Don Kaufman

1 × $6.00 -

×

How To Trade the Best Currency Pairs Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade the Best Currency Pairs Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00

How To Create Your Own Trading Strategy with Simon Klein - Trade Smart

1 × $5.00 -

×

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00

Full-Day Platinum Pursuits Basic Option Seminar Manual

1 × $6.00 -

×

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00

Monthly Cash Flow Trading Options (Intermediate Option Trading Course) with Randy Perez

1 × $85.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00

Modern Portfolio Theory and Investment Analysis (7th Edition) with Edwin Elton, Martin Gruber, Stephen Brown & William Goetzmann

1 × $6.00 -

×

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00 -

×

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00 -

×

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00

Trend Following: How Great Traders Make Millions in Up or Down Markets with Michael Covel

1 × $6.00 -

×

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00 -

×

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00

Market Science Volumes I & II Square of Twelve & Market Dynamics with Bradley Cowan

1 × $4.00 -

×

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00 -

×

Rhythm of the Moon with Jack Gillen

1 × $4.00

Rhythm of the Moon with Jack Gillen

1 × $4.00 -

×

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00

90 Days To Trade MasterClass with Jerremy Newsome & Matt Delong - Real Life Trading

1 × $104.00 -

×

Big Fish Trading Strategy with Dave Aquino

1 × $6.00

Big Fish Trading Strategy with Dave Aquino

1 × $6.00 -

×

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00

Module 1 & 2 Swing Trading Forex and Financial Futures with Trader Dante

1 × $15.00 -

×

PennyStocking with Timothy Sykes

1 × $5.00

PennyStocking with Timothy Sykes

1 × $5.00 -

×

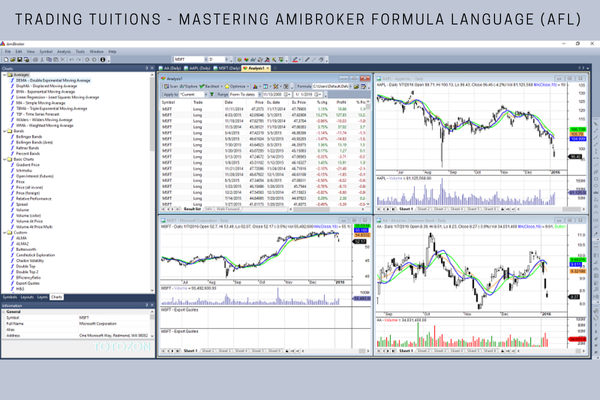

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00 -

×

Into The Abbys with Black Rabbit

1 × $18.00

Into The Abbys with Black Rabbit

1 × $18.00 -

×

The Obnoxious Profit Method – Truly Obnoxious Profits Strategy {TOPS}

1 × $15.00

The Obnoxious Profit Method – Truly Obnoxious Profits Strategy {TOPS}

1 × $15.00 -

×

Value Investing Bootcamp with Nick Kraakman

1 × $15.00

Value Investing Bootcamp with Nick Kraakman

1 × $15.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

Trading Ist Ein Geschaft (German) (tradingeducators.com)

1 × $6.00

Trading Ist Ein Geschaft (German) (tradingeducators.com)

1 × $6.00 -

×

Pinpoint Profit Method Class

1 × $31.00

Pinpoint Profit Method Class

1 × $31.00 -

×

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00 -

×

Big Mike Trading Webinars

1 × $6.00

Big Mike Trading Webinars

1 × $6.00 -

×

Advanced Price Action Techniques with Andrew Jeken

1 × $6.00

Advanced Price Action Techniques with Andrew Jeken

1 × $6.00 -

×

TheoTrade

1 × $31.00

TheoTrade

1 × $31.00 -

×

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00

Advanced Volume Profile + Order Flow Video Course with Trader Dale

1 × $13.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Cyber trading university - Pro Strategies for Trading Stocks or Options Workshop

1 × $15.00

Cyber trading university - Pro Strategies for Trading Stocks or Options Workshop

1 × $15.00 -

×

Intra-Day Trading Nasdaq Futures Class with Tony Rago - Theo Trade

1 × $4.00

Intra-Day Trading Nasdaq Futures Class with Tony Rago - Theo Trade

1 × $4.00 -

×

The GBP USD Trading System with A.Heuscher

1 × $6.00

The GBP USD Trading System with A.Heuscher

1 × $6.00 -

×

Activedaytrader - Workshop Options For Income

1 × $15.00

Activedaytrader - Workshop Options For Income

1 × $15.00 -

×

XLT– Option Trading Course

1 × $6.00

XLT– Option Trading Course

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Andrew Keene's Most Confident Trade Yet

1 × $54.00

Andrew Keene's Most Confident Trade Yet

1 × $54.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Better Butterfly Course with David Vallieres – Tradingology

1 × $39.00

The Better Butterfly Course with David Vallieres – Tradingology

1 × $39.00 -

×

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00 -

×

Price action profits formula v2

1 × $31.00

Price action profits formula v2

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Forex Advanced with Prophetic Pips Academy

1 × $5.00

Forex Advanced with Prophetic Pips Academy

1 × $5.00 -

×

The Works (Full Educational Course) with Waves 618

1 × $39.00

The Works (Full Educational Course) with Waves 618

1 × $39.00 -

×

Arjoio’s MMT - Essential Package

1 × $5.00

Arjoio’s MMT - Essential Package

1 × $5.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

PPC Lead Pro Training Program

1 × $31.00

PPC Lead Pro Training Program

1 × $31.00 -

×

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

Winning With The Market with Douglas R.Sease

1 × $6.00

Winning With The Market with Douglas R.Sease

1 × $6.00 -

×

The Whale Order with The Forex Scalpers

1 × $5.00

The Whale Order with The Forex Scalpers

1 × $5.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

The Options Doctor: Option Strategies for Every Kind of Market with Jeanette Schwarz Young

1 × $6.00

The Options Doctor: Option Strategies for Every Kind of Market with Jeanette Schwarz Young

1 × $6.00 -

×

Bullseye Trading Course with Ralph Garcia

1 × $39.00

Bullseye Trading Course with Ralph Garcia

1 × $39.00 -

×

STREAM ALERTS

1 × $6.00

STREAM ALERTS

1 × $6.00

The Stock Market Crash of 1929 The End of Prosperity with Brenda Lange

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The Stock Market Crash of 1929 The End of Prosperity with Brenda Lange ” below:

The Stock Market Crash of 1929: The End of Prosperity with Brenda Lange

Introduction

The Stock Market Crash of 1929 marks one of the most pivotal moments in financial history, heralding the onset of the Great Depression. Brenda Lange’s insightful analysis helps us understand the depth and consequences of this catastrophic event.

The Prelude to the Crash

A Decade of Prosperity

The 1920s, often referred to as the “Roaring Twenties,” was a period of vibrant economic growth and widespread prosperity in the United States.

The Rise of Stock Speculation

An era marked by a remarkable increase in stock market investment, often fueled by excessive speculation and margin buying.

Black Thursday: The Beginning of the Crash

October 24, 1929

The day the stock market took a dramatic plunge, setting off a chain of panic and selling.

Initial Impact

Millions of shares were sold in a frenzy, causing a massive decline in stock prices.

The Critical Days Following Black Thursday

Black Monday and Black Tuesday

October 28 and 29 saw further steep declines in the stock market, wiping out billions of dollars in market value.

Public Panic

The rapid decline led to widespread panic among investors and the general public alike.

Economic Ripple Effects

Bank Failures

The crash led to a crisis in the banking sector, with numerous banks closing their doors as a result of the financial strain.

Unemployment Surge

As companies bankrupted or cut costs, unemployment rates soared, exacerbating the economic downturn.

Government Response

Immediate Measures

Initial governmental responses were limited, as there was little precedent for such an economic crisis.

The Long-term Reforms

The crash eventually led to significant financial reforms, including the creation of the Securities and Exchange Commission (SEC) to regulate the stock market.

Social Consequences

Loss of Consumer Confidence

The crash severely damaged consumer confidence, which took years to rebuild.

Changes in American Lifestyle

Many American families had to alter their lifestyles drastically, often adopting more frugal habits.

Analyzing the Causes

Overvaluation of Stocks

A critical look at how stocks were highly overvalued relative to their actual earnings and potential.

Lack of Regulations

The absence of stringent financial regulations allowed for rampant speculation and risky investment practices.

Lessons Learned

The Importance of Oversight

The crash underscored the need for more robust financial regulations to prevent future economic disasters.

Economic Warning Signs

Understanding the indicators that can signal an over-heated economy or financial market.

Modern Implications

Comparisons with Recent Financial Crises

Drawing parallels between the 1929 crash and more recent financial crises, exploring what lessons remain relevant today.

The Role of Technology in Modern Markets

How technological advancements have transformed trading and regulatory practices.

Conclusion

The Stock Market Crash of 1929, as analyzed by Brenda Lange, was not just a financial crisis but a transformative event that reshaped U.S. economic policy and the financial landscape. By studying this historical episode, we gain valuable insights into the dynamics of market economies and the critical importance of financial regulation.

Frequently Asked Questions

- What exactly triggered the Stock Market Crash of 1929?

- The crash was primarily triggered by rampant speculation, excessive stock market leverage, and eventually, mass panic among investors.

- How long did the market take to recover from the 1929 crash?

- It took over 25 years for the stock market to regain the levels seen before the crash.

- Could the 1929 crash have been prevented?

- Potentially, with stricter financial regulations and better oversight of stock market practices, the severity of the crash could have been mitigated.

- What were the major economic lessons learned from the 1929 crash?

- Major lessons include the importance of regulatory oversight, the dangers of speculative bubbles, and the need for government intervention in times of economic crisis.

- How did the 1929 crash affect ordinary people?

- Many lost their life savings, jobs, and homes, which contributed to widespread economic hardship during the Great Depression.

Be the first to review “The Stock Market Crash of 1929 The End of Prosperity with Brenda Lange” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.